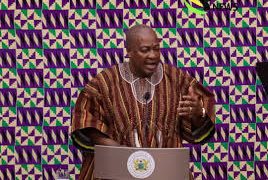

Ghana’s cocoa sector, the historical spine of its economy, is currently facing a structural heart attack. The emergency Cabinet meeting scheduled by President John Dramani Mahama for Wednesday, February 11, 2026, is more than a routine government briefing; it is a desperate attempt to resuscitate a multi-billion-dollar industry gasping for liquidity. For the Ghanaian farmer, the crisis is not found in balance sheets but in empty pockets and the silent warehouses of Licensed Buying Companies (LBCs). The current deadlock represents a failure of both old-school debt reliance and a premature leap into untested private-financing models.

The LBC Debt Trap: A $185 Million Fault Line

The crisis has hit a breaking point as LBCs reveal they are owed approximately $185 million (GH¢2.04 billion) by COCOBOD. Samuel Adimado, President of the Licensed Cocoa Buyers Association, disclosed that some members have gone unpaid for two consecutive seasons. This massive debt has trapped LBCs between unpaid farmers and aggressive banks. While LBCs traditionally pre-financed purchases through bank loans, the nine-month reimbursement delays seen in the 2023/24 season have exhausted their credit lines. Consequently, LBCs now owe banks more than they owe farmers, effectively freezing the domestic buying market.

The Collapse of the Syndicated Safety Net

For three decades, the syndicated loan model acted as the reliable engine for Ghana’s cocoa purchases. This system allowed the Ghana Cocoa Board (COCOBOD) to borrow billions against future harvests, ensuring farmers were paid in cash upon delivery. That engine has now seized. After abandoning the system in 2024 to avoid high interest costs, the refusal of international lenders to participate in the 2025/2026 season signals a profound loss of confidence. When a state institution fails to honour over 333,000 tonnes of existing contracts, as CEO Dr Ransford Abbey admitted, it breaks the primary rule of global trade: your word is your bond.

“Credibility is the only currency that matters in global commodities. Once you fail to deliver on a forward contract, you aren’t just losing money; you are losing the future market,” says an international trade consultant familiar with the West African market.

The 80/20 Paradox and Price Volatility

The government’s attempt to pivot toward a buyer-led financing model has proved catastrophic. By asking international traders to pre-finance 80% of purchases, Ghana effectively handed the steering wheel to the private sector during extreme price swings. When global prices sat at $12,000 (GH¢132,000) per tonne, the model seemed plausible. However, as prices retreated toward $4,000 (GH¢44,000), traders vanished.

Ghana’s cocoa is now caught in a “too expensive” bracket, as the annual farmgate price of GH¢51,660 ($4,696) per tonne remains higher than what many international buyers are currently willing to pay. This has left 50,000 metric tonnes of unsold cocoa sitting at ports—a physical manifestation of a pricing strategy that failed to account for market gravity.

Political Gridlock and Broken Promises

Internal friction and partisan heat are worsening the financial drought. The Minority Caucus in Parliament has accused the Mahama administration of “dishonesty,” pointing to a failure to honour the promised GH¢6,000 per bag price, which was later slashed to GH¢3,625. Furthermore, reports of a power struggle between the leadership of COCOBOD and the Cocoa Marketing Board suggest that administrative paralysis is stifling urgent decision-making.

“Outrageous promises were made in opposition, but the reality in government is a default on even reduced payments,” stated Isaac Yaw Opoku, Ranking Member on Food and Agriculture. “Farmers are unable to feed families or buy medicine while the top hierarchy is locked in a power struggle.”

The Fragile Frontline: Voices of the Ground

At the heart of this crisis are the smallholder farmers and the clerks who manage the trade. The human cost is staggering. “From November till now, I can’t sleep,” says one purchasing clerk with 20 years of experience. “I have taken 250 bags of cocoa from farmers, and they are always at my doorstep demanding their money.”

The frustration has turned into an ultimatum. “I sold my cocoa on November 28, but I still haven’t received payment,” says Nana Owusu Asim Panin II, a community leader in the Ashanti Region. “We have children in school. If this isn’t fixed, we might end up selling our cocoa to illegal gold miners (galamseyers) just to get our money.”

Global Ripples: From Port to Pantry

For international chocolate manufacturers and consumers, Ghana’s instability is a supply-chain nightmare. Ghana provides the high-quality “premium” beans required for fine chocolate. A shortfall—even as production is forecast to recover to 750,000 metric tons—forces global brands like Hershey’s and Mondelēz to turn to alternative producers in Latin America, such as Ecuador. While consumers in Europe and North America see “shrinkflation” as prices stabilise, the long-term risk is “demand destruction.”

Source: myjoyonline.com