Producer prices increased sharply on a monthly basis in January 2026 even as annual producer inflation slowed significantly, latest data released by the Ghana Statistical Service (GSS) have shown.

The Producer Price Index (PPI), which measures the average change in prices received by domestic producers for goods and services, rose to 274.9 in January 2026 from 266.0 in December 2025. This represents a month-on-month increase of 3.3 percent, signalling renewed short-term price pressures across key productive sectors.

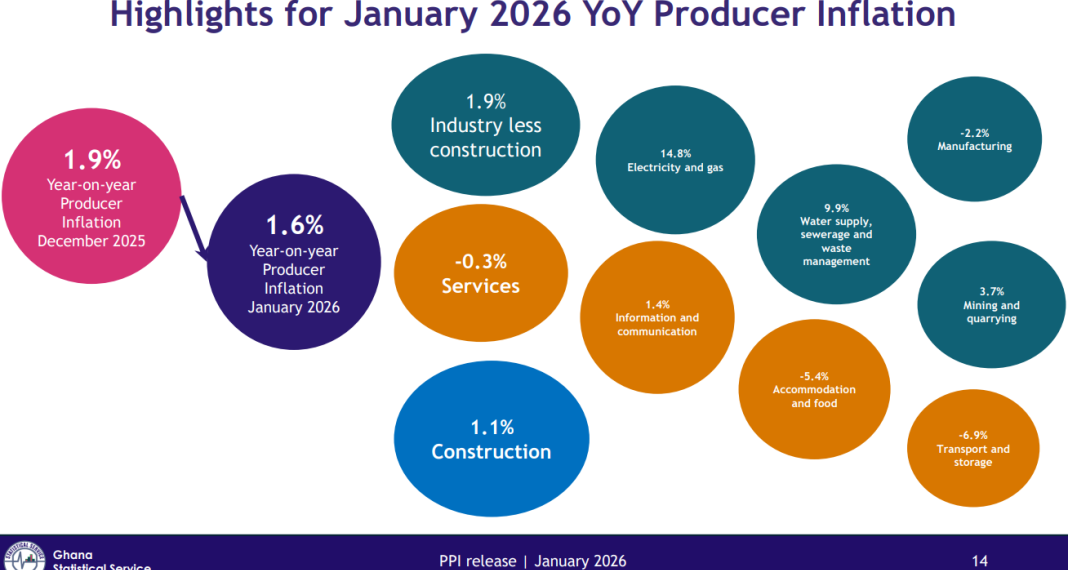

However, on a year-on-year basis producer inflation eased to 1.6 percent in January 2026; down from 1.9 percent recorded in December 2025.

This also marks a sharp decline of 26.9 percentage points compared to the 28.5 percent recorded in January 2025, reflecting a substantial moderation in factory-gate price increases over the past year.

GSS noted that the moderation in annual inflation indicates that, on average, prices received by producers rose only marginally between January 2025 and January 2026, suggesting relative stability in production costs compared to elevated levels seen the previous year.

Sectoral breakdown

At the aggregate level, the Industrial Producer Price Index (I-PPI) – which excludes construction – recorded a year-on-year inflation rate of 1.9 percent in January 2026, down from 2.1 percent in December 2025. On a month-on-month basis, the sector increased sharply by 4.0 percent, indicating that short-term price pressures were concentrated within core industrial activities.

The Construction Producer Price Index (C-PPI) recorded a year-on-year inflation rate of 1.1 percent in January 2026, easing from 1.7 percent in December 2025. On a monthly basis, construction prices declined by 0.3 percent, suggesting relatively stable cost conditions within building and civil engineering works.

Meanwhile, the Services Producer Price Index (S-PPI) recorded a year-on-year decline of 0.3 percent in January 2026 compared to marginal growth of 0.2 percent in December 2025. On a month-on-month basis, service producer prices fell by 0.5 percent – reflecting continued price moderation across service-related activities.

A closer look at the industrial sub-sectors showed mixed trends. Mining and quarrying – the PPI’s largest component with a weight of 43.7 percent – recorded an increase of annual inflation from 3.3 percent in December 2025 to 3.7 percent for January 2026. The sector was a major contributor to overall inflation due to its dominant share in industrial output.

In contrast, the manufacturing sector – which accounts for 35 percent of the index – recorded a decline in producer inflation, falling from 0.1 percent in December 2025 to negative 2.2 percent in January 2026. This contraction in manufacturing prices contributed significantly to the overall slowdown of annual producer inflation.

Other sectors recorded notable increases. Inflation in the electricity and gas sector rose sharply to 14.8 percent in January 2026 from 6.1 percent the previous month, while the water supply, sewerage and waste management sector recorded inflation of 9.9 percent… up from 2.3 percent in December 2025.

On the services side, transport and storage continued to record declining prices with inflation falling further from negative 3.7 percent in December 2025 to negative 6.9 percent in January 2026. Similarly, accommodation and food service activities recorded a decline of negative 5.4 percent, indicating easing price pressures in those sectors.

On a month-on-month basis, the increase in producer prices was largely driven by mining and quarrying which recorded a 7.0 percent increase, alongside electricity and gas at 8.6 percent and water supply and waste management at 7.5 percent. Manufacturing prices however declined marginally, by 0.4 percent over the same period.

GSS noted that the rise in monthly inflation reflects short-term price movements, while the decline in annual inflation signals broader price stability compared to the previous year.

Recommendations

GSS noted: “With moderate YoY inflation but strong MoM growth, authorities should closely monitor short-term price momentum to prevent reacceleration”.

It added that while the decline in transport inflation is a positive signal for cost competitiveness, government policies should focus on maintaining fuel supply stability and improving logistics efficiency.

The Service also advised households and businesses to adjust their spending and pricing strategies in response to evolving producer price trends. Consumers are encouraged to prioritise goods and services with stable prices to protect their purchasing power, while businesses – particularly those relying on manufactured inputs – are urged to negotiate medium-term supply contracts to secure favourable pricing amid declining manufacturing inflation. Firms are also advised to exercise caution when adjusting prices in response to the recent 3.3 percent monthly increase to avoid weakening demand.

Source : bftonline.com