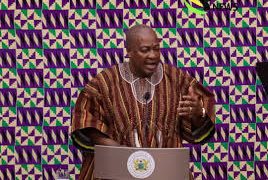

Governor of the Bank of Ghana (BoG), Dr Johnson Pandit Asiama, is projecting inflation to hit between 4 and 6 per cent before the end of the year.

In his opening remarks during the 127th Monetary Policy Committee (MPC) sitting on Monday, November 24, he said that what stands out this quarter is the broad momentum in economic activity. Growth has been stronger and more diversified than anticipated.

The first half of the year recorded 6.3 per cent Gross Domestic Product (GDP) growth, driven by vibrant expansion in services and agriculture, while non-oil GDP surged to 7.8 percent. High-frequency indicators echo this trend: the Composite Index of Economic Activity is up about 9 percent, and business and consumer sentiments remain firmly positive.

Taken together, jhe said, these gains confirm that the negative output gap is narrowing, and the economy is gradually shifting from recovery to expansion.

But the turnaround is not accidental, he said.

“It reflects sustained fiscal discipline, a cautious but determined monetary stance, and structural policy reforms, particularly the improvements in the FX operations framework and the rebuilding of external buffers. The 2026 Budget reinforces this discipline and places growth and job creation at the centre of Ghana’s next phase of economic transformation,” he said.

Looking ahead, he added, the growth outlook remains favourable. Staff projections, supported by recent real-sector indicators, suggest that the economy will maintain a steady expansion path through 2026. The strong harvest season, improved food supply dynamics, enhanced FX liquidity, and the easing credit environment all provide support for continued growth. Non-oil sectors, services, industry, and agriculture are expected to remain the key drivers.

“The broader macro-framework also supports this trajectory. Money supply growth has moderated significantly, helping anchor inflation. Real rates remain high, creating room for a carefully calibrated easing cycle. And with inflation likely to settle between 4–6 percent by year-end before stabilising around the target band in 2026, Ghana is entering what could become a multi-year period of price stability.

“At the same time, the global environment remains fragile, and we must remain alert to risks, commodity price swings, geopolitical tensions, and tighter external financial conditions. Domestically, pressures around taxes, utilities, and costs of credit continue to weigh on business activity, even amid improved optimism,” Dr Asiama said.

Source: 3news.com